Calculate my tax refund

585 cents per mile. If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive.

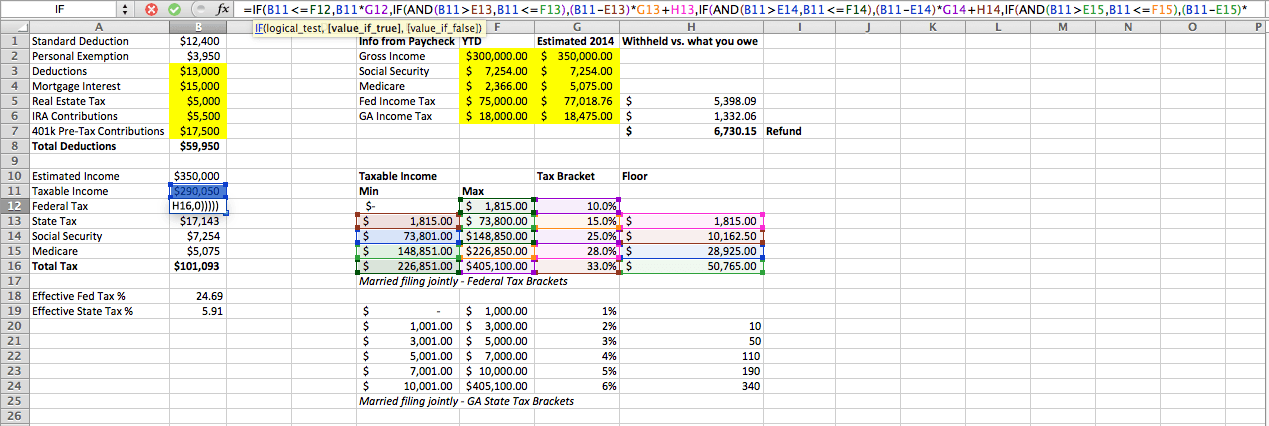

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The tax refund calculator shows your ATO tax refund estimate.

. For simplicitys sake the tax tables list all income over 3000 in 50 chunks. Determine if youll get a refund or need to pay taxes. SARS has changed things up a bit this year and advised that they have 7 business days in which to pay out a refund.

Research and factor in the allowances offered by your state. Tax Deducted at Source or TDS is the amount which is deducted from the income of an individual by an authorised deductor and deposited to the IT department. My local bank denied my application to cash the check.

Just enter your information and get an estimate of your tax refund. At My Tax Refund Today it is our mission to get you the maximum back on your tax return. Typically the IRS will mail you out a notice if your tax refund is different from the amount you claimed on your tax return.

The graphics and sliders make understanding taxes very easy and it updates your estimate as you add in information. Please wait at least eight weeks before checking the status of your refund. The notice will include information on the refund you were eligible for the amount your tax refund was reduced by what agency the money was sent to and contact information for that agency.

The Taxback team made it very easy and uncomplicated for me to access my tax back. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. Medical and moving mileage.

Fastest federal tax refund with e-file and direct deposit. 2021 tax return due in 2022 2022 tax return due in 2023 Business mileage. Use TaxTim to make the process simple and get your maximum possible tax refund this tax season.

The more details you add to your tax return the more accurate the tax calculator becomes It is accurate to the cent based on the information you add to your return and it updates as you go. Tax Refund Apart from it being a legal obligation to submit your annual tax returns for many its an opportunity to receive a refund from SARS for overpaying on tax during the tax year. When you sell the property the basis reported on your tax return depends on whether the property is sold at a gain or loss.

Calculate your UK Tax Rebate for free. Fastest tax refund with e-file and direct deposit. An Income tax calculator is an online tool designed to calculate how much income tax you are liable to pay in any given financial year.

February 20 2014 at 828 am. Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. Important IRS penalty relief update from August 26 2022.

Do I have to pay taxes on the refund at my higher 2012 tax bracket rate or is there some way to pay it at my lower 2011 tax bracket rate. The IRS issues more than 9 out of 10 refunds in less than 21 days. For property that has changed from personal to business use the basis used to calculate depreciation ie.

14 cents per mile. Tax refund time frames will vary. When you e-file your tax return to the IRS it needs approximately three days to update your information on the website.

Fastest Refund Possible. To illustrate lets say your taxable income Line 15 on Form 1040 is 41049. West Virginia Tax Brackets.

Average tax refund for Canada is 998 - get your Canadian Tax Back Now. I worked in the US and now I have received a tax refund check. How do I calculate my state tax refund.

File your taxes for 0 File advanced and simple taxes for free. The tables only go up to 99999 so if your income is 100000 or higher you must use a separate worksheet found in the Form 1040 Instructions to calculate your tax. 16 cents per mile.

Learn all about Income Tax Income Tax Return efiling Income Tax and Income Tax Refund in our other pages. I was thankful to the one who assisted me as I process my tax refund. The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late.

How do I calculate TDS on my salary. 14 cents per mile. For the most up-to-date refund information visit Wheres My Refund on IRSgov.

By doing so you may receive a refund for some or. 24 hours after the IRS accepts your e-filed tax return-OR-4 weeks after you mail your paper return. Check Status of IRS Refund on IRSgov.

TurboTax Tax Refund Calculator. Get your tax refund up to 5 days early. We have helped thousands of Australians with their taxes over the years and will continue to help thousands more.

To find out the status of your refund youll need to contact your state tax agency or visit your states Department of Revenue. 18 cents per mile. It was a great service.

1-800-982-8297 Email Tax Support. Most tax filing programs like Turbo Tax will automatically calculate the taxable portion if you enter the amount decalred on the 1099-G form. Use your W-2s from your employers to calculate how much money was taken out of your wages for state taxes.

If you e-filed your tax return using TurboTax you can check your e-file status online to ensure it was accepted by. Then find out what tax bracket youre in. Start Your Tax Return Tax Refund In Australia.

Check Status of IRS Refund on IRSgov. Etax includes the all tax cuts and tax rebates in your refund estimate for 2022. The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic.

An excellent tool is the TurboTax tax refund calculator. It was a great service. The TDS can be calculated by following a few simple steps.

Calculate Checking Accounts 101 Emergency Savings Calculator. Fastest refund possible. However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method.

The calculator provides an approximate figure of your income tax liability by taking into account various data such as. The only way you can get an income tax refund get tax back from SARS is to complete and submit your tax return. This entry was posted in TaxTims Blog and tagged Audit Verification SARS eFiling.

Tax refund time frames will vary. 56 cents per mile. Wait at least three days after e-filing your tax return before checking a refund status.

The West Virginia state income tax is similar in structure to the federal income tax. Use our Free Canadian Tax Refund Calculator to calculate your refund. If the federal income tax liability you projected is greater than your withholding and payments you may have a payment due when you file.

Compare the federal income tax liability that you calculated to your total projected federal income tax withholding and estimated payments for the year. Average tax refund for UK is 963. The IRS issues more than 9 out of 10 refunds in less than 21 days.

TaxHelpWVGov 2020 State Tax Filing Deadline. Checking your tax refund status online. Get Your Tax Refund Now.

Estimating your tax refund or balance owed does not have to be complicated. The depreciable basis is generally the lesser of adjusted basis or FMV of the property at the time of conversion. I was thankful to the one who assisted me as I process my tax refund.

How To Calculate Taxable Income H R Block

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Calculating Income Tax Payable Youtube